How to Implement ASC 842 Lease Accounting — and Should You DIY?

FASB ASC 842 lease accounting compliance is coming to a year-end near you.

The standards board pushed back the deadline twice during the pandemic years, but this time, it’s here to stay. Many businesses have wisely put off implementation until now, but it’s time to start thinking about what you need to do to meet this standard.

Many great resources out there explain what ASC 842 means, but how do you actually “do the dang thing?”

We spoke with Managing Director Megan Cox-Artemis to get the inside scoop on implementing this standard — and how CCN consultants can help!

What does ASC 842 mean for your business?

If yours is a small business with a few lease agreements, you may be able to comply with ASC 842 in a few hours.

But what if you have dozens or hundreds of leases — cars, servers, computers, office space, and more?

It could take your staff days to track down every lease you have, especially those mentioned in other contracts. And then, someone has to review them and enter all the information into a spreadsheet or lease accounting software.

“We had a consultant who worked with a company that had over 200 leases. She spent two months out there reviewing all of them.”

Megan Cox-Artemis

If this is you, don’t worry! It can be tedious, but a clear plan and process will get you compliant. Let’s break it down.

Lease length

Create a schedule including every single lease your business has. Your first question has to do with the time remaining on each lease.

Will any leases end within the next 12 months? There’s no need to put them on the balance sheet.

Remember, you’ll still need to show the auditors that you assessed those leases, even if they don’t end up on the balance sheet.

If any leases extend beyond the next 12 months, you may have to include them on your balance sheet under the new guidance. You’ll need to make those determinations and calculations on a per-lease basis.

Lease type

Next, calculate lease payments, fair value, present value, and other yes/no questions in your workbook.

One key change under ASC 842 has to do with terminology. You’ll need to familiarize yourself with the new terms for lease types:

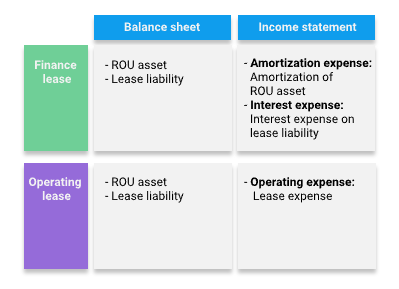

Operating lease: When your payments don’t account for the majority of the fair value of the asset. You don’t assume risks and responsibilities. This might include a short-term (12-month or less) lease of shared office space. It could also include a multi-year vehicle lease.

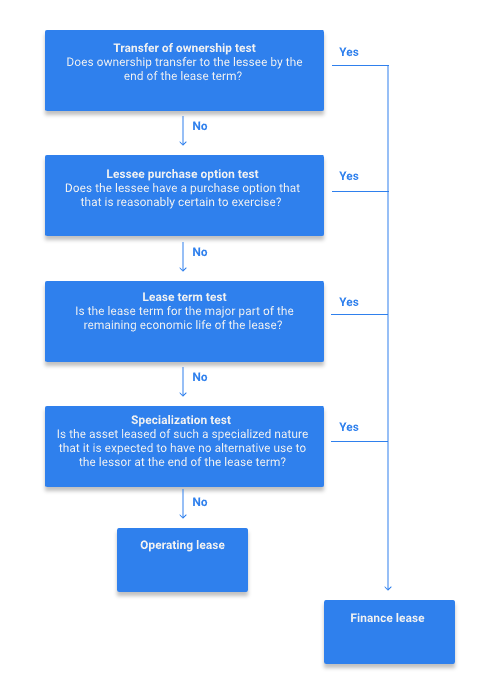

Finance lease (formerly a capital lease): When you end up with the majority of the asset’s fair value or useful life. In some cases, you may even own the asset at the end of the lease (like purchase financing or lease-to-own). Management needs to decide what the fair value and useful life may be, and from there, you can determine if it qualifies as a capital lease by answering five yes/no questions.

The first steps in complying with ASC 842

Converting to ASC 842 is time-consuming, so it’s best to carve it into smaller tasks. Your first one is to find all the lease documents. Your staff will need to do that regardless of how you proceed.

While they’re locating those documents, you can investigate lease accounting software options. A lease accounting system is dedicated software that helps you create reports that are ASC 842-compliant. These include variable lease costs, interest paid on lease liabilities, and right-of-use amortization.

Some of these packages use cloud-based artificial intelligence (AI) that’s ready for ASC 842. The software reads through every spreadsheet and PDF you scan in.

The AI automates data extraction, finding and pulling out all the information related to each lease. It then performs the required calculations, makes monthly journal entries for you, and creates reports.

When you’re through with initial adoption, all the heavy lifting is done to help you comply with ASC 842 in future years.

When to start

The more leases you have, the earlier your staff will need to start the search for paper and digital documents. But don’t start too early.

“People ask me, ‘Do I start looking at this at the end of Q3?’ I recommend starting in November, then double-checking everything in January. This gives you a chance to keep more short-term leases off your balance sheet and an extra 15 days for year-end reporting!”

Megan Cox-Artemis

With a December 31 fiscal year-end, you’ll want to start this project in early November or perhaps late October if you have a lot of lease documents to find.

This will ensure you have the time to double-check everything before the auditors review your books.

Can you afford to do it yourself?

Complying with ASC 842 the first time is a large, tedious project. Reviewing documents and loading them into the software could take weeks or months, depending on how many leases you have.

You’ll need to determine how much time and energy you’re prepared to invest in a one-and-done project that comes with the risk of non-compliance.

In today’s uncertain economy, your finance and accounting staff has to do more with less. So they may not have the bandwidth to take on a project of this size and importance in time to meet your fiscal year-end deadline.

You may decide it’s more time- and cost effective to bring in someone to do the document reviews and load them into your lease accounting software.

We can help!

CCN’s consultants are F&A professionals with ASC 842 compliance and lease accounting software experience.

We’ve gone through ASC 842 implementation many times before, and that background translates to an efficient and effective process for your company. Your consultant will work with you and your staff to have all your documents and reports auditor-ready for your 2022 fiscal year-end.

Send us a message or call 512-900-2152 to schedule a personal conversation with one of our accounting experts about your ASC 842 compliance nee

Related Posts

Grow your business with industry news and resources from CCN.

2025 Consultants Club: Meet Amy Byron!

At CCN, we’re all about celebrating the incredible talent that fuels our community—and Amy Byron, CPA, is…

2025 Consultants Club: Meet Tracy McGehee!

At CCN, we are all about celebrating the remarkable achievements of our consultants. One of our shining…

2025 Consultants Club: Meet Jessica Smith!

We’re excited to congratulate Jessica Smith on earning a spot in CCN’s prestigious 2025 Consultants Club! 🎉…